Child Care Tax Credit 2020 Form

For best results download and open this form in Adobe Reader. There are some qualifying rules and income matters.

Who S A Dependent For Stimulus Checks New Qualifications How To Claim 2020 Babies Cnet

You must complete Part III of Form 2441 before you can figure the credit if any in Part II.

Child care tax credit 2020 form. See General information for details. You may only claim one credit even if you care for more than one child. File taxes using Form 1040 or 1040NR.

20 Zeilen Form 1040 Schedule 8812 SP Additional Child Tax Credit Spanish Version 2020. Amount of child care expenses for each specific child. In previous years -- including tax year 2020 -- the maximum amount you could claim for multiple children was 6000.

Complete lines 2e through 4 as instructed on the form. Arent filing separate returns if youre married. You will claim the other half when you file your 2021 income tax return.

You can use the Child Tax Credit Update Portal to opt out of the program anytime. 35 of all qualifying expenses up to a maximum of 3000 for one childdependent. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021.

In addition if you or your spouse if filing jointly received any dependent care benefits for 2020 you must use Form 2441 to figure the amount if any of the benefits you can exclude from your income. Those percentages appear on Line 8 of Form 2441 the form used to calculate and claim the child care credit. T778 Child Care Expenses Deduction for 2020.

There are some qualifying rules and income matters. Form 2441 Department of the Treasury Internal Revenue Service 99 Child and Dependent Care Expenses Attach to Form 1040 1040-SR or 1040-NR. The value of this tax credit.

This is a tax credit which means it reduces your tax bill on a dollar-for-dollar basis. The credit increases to 3600 if the child is under 6 on Dec. Any child that you support and maintain at your own expense.

It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or 1040-SR line 27. Child Tax Credit rates. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later.

The maximum annual Child Tax Credit rates are shown below. Go to wwwirsgovForm2441 for instructions and the latest information. The child tax credit is also.

This credit came into effect on 1 January 2014. If line 4 is 60000 or less enter the amount from line 9 of the IRS form 2441 Child and Dependent Care Expenses on. Names shown on return.

If the amount on line 4 is greater than 60000 do not continue because you do not qualify for this credit. You qualify for the child care tax credit as long as you. Up to 6000 for two or more childrendependents.

The maximum percentage of 35 is only available to people with AGIs of 15000 or below. Only one parent or guardian of a child can claim the SPCCC in a tax year. The IRS will pay half the total credit amount in advance monthly payments.

You can view this form in. Well make the first advance payment on July 15 2021. Youll only need to unenroll once and youll be able to re-enroll in late September if you need to.

If you care for a child on your own you may be able to claim the Single Person Child Carer Credit SPCCC. Rates per year 2021 to 2022. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit of either.

For people with visual impairments the following alternate formats are also available. Under the new law youll be able to. If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses.

So the maximum credit available to a person who pays care expenses for one qualifying individual is 3000 times 35 or 1050. Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit. This child may be.

The Child Tax Credit is worth as much as 2000 for the 2020 tax year and up to 1400 of that can be refundable. Form IT-216 Claim for Child and Dependent Care Credit Tax Year 2020 Created Date.

1040 Schedule 3 Drake18 And Drake19 Schedule3

1040 Schedule 3 Drake18 And Drake19 Schedule3

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Irs Child Tax Credit Payments Start July 15

/claiming-adult-dependent-tax-rules-4129176_color3-29b00ca3129544f9b2dbc50675d04c90.gif)

Tax Rules For Claiming Adult Dependents

Tax Implications And Rewards Of Grandparents Taking Care Of Grandchildren The Cpa Journal

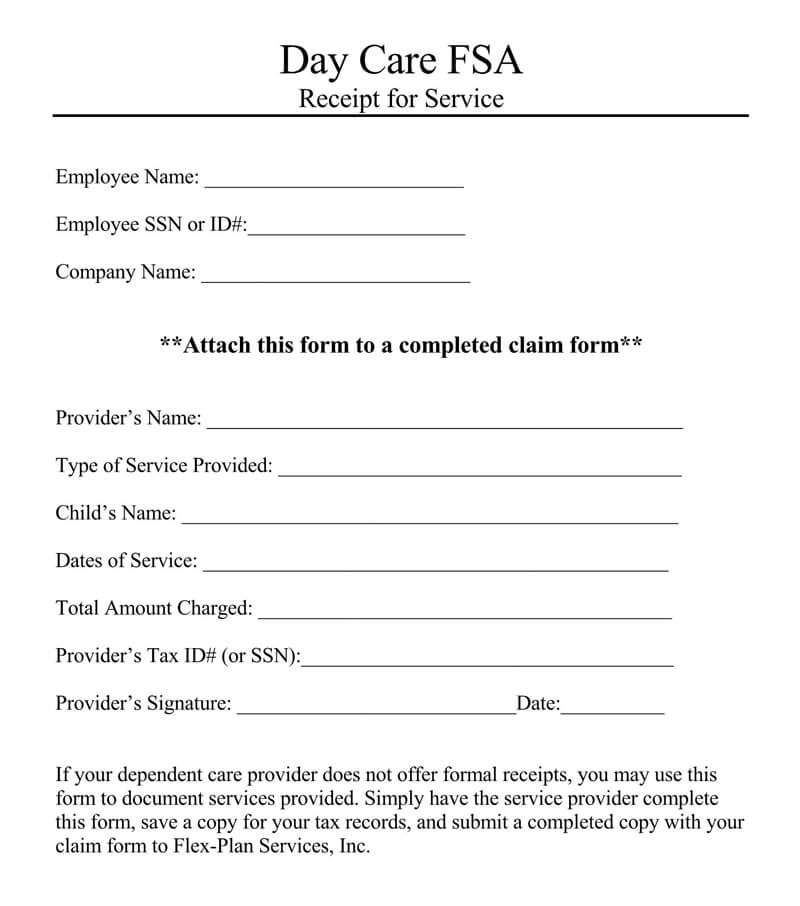

10 Free Daycare Receipt Templates Word Pdf

Forms 1040 1040nr And 1040nr Ez Which Form To File 2021

Your Child Care Payments Could Get You Up To 16 000 In Credits Everything To Know Cnet

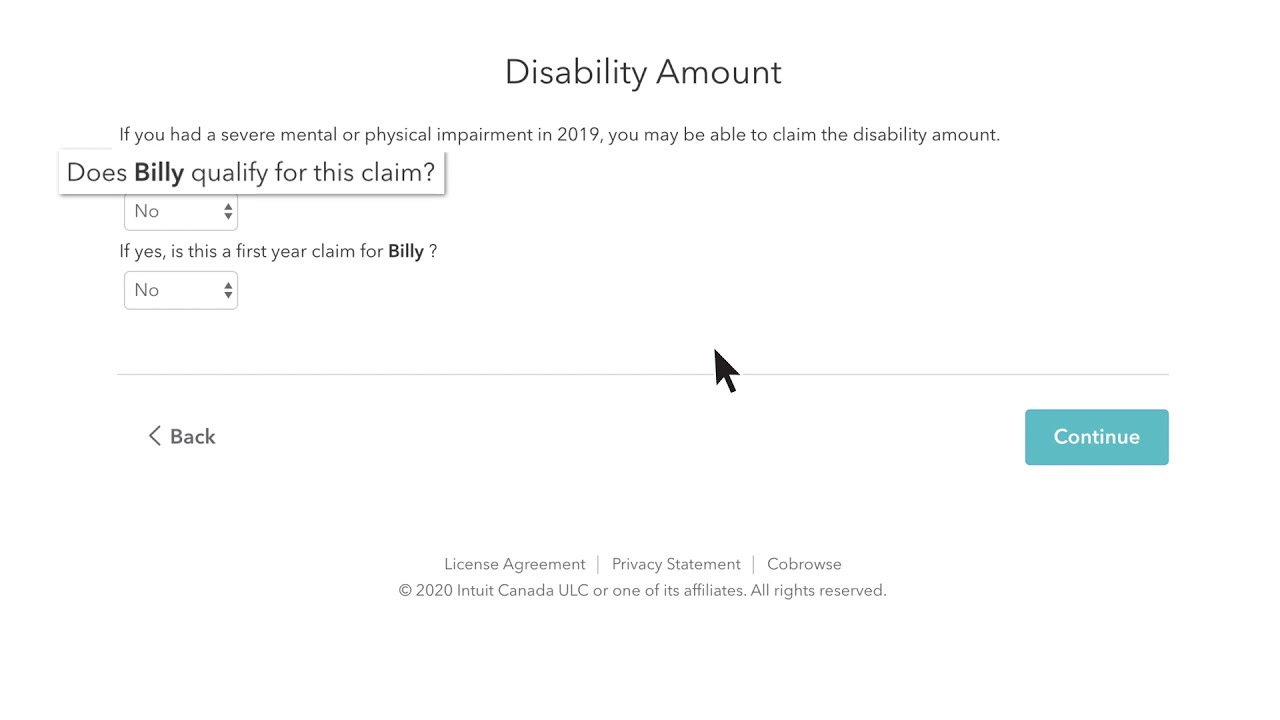

A Guide To The Disability Tax Credit 2021 Turbotax Canada Tips

Payment Schedule For Child Tax Credit 300 Monthly Checks Start Arriving July 15 Cnet

10 Free Daycare Receipt Templates Word Pdf

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Advance Child Tax Credit Payments Going Out This Week Nbc 5 Dallas Fort Worth

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions

3 11 3 Individual Income Tax Returns Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

/ScreenShot2021-02-11at1.09.54PM-a0f5478dda0b440f99a2d4d10e61321e.png)

Posting Komentar untuk "Child Care Tax Credit 2020 Form"