Child Tax Credit And Credit For Other Dependents Worksheet 2020 Form

To claim the child tax credit andor the credit for other dependents you cant be a dependent of another taxpayer. The Child Tax Credit is a tax credit available to taxpayers for each of their qualifying dependent children or other family members.

Instructions For Form 8995 2020 Internal Revenue Service

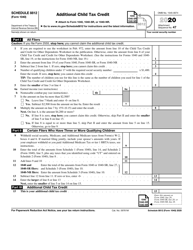

In addition to the nonrefundable Child Tax Credit and Credit for Other Dependents that is claimed on Line 12a of Form 1040 a taxpayer with one or more qualifying children may be able to claim the refundable Additional Child Tax Credit on Schedule 8812.

Child tax credit and credit for other dependents worksheet 2020 form. Child Tax Credit and Credit for Other Dependents WorksheetContinued. For instructions and the latest information. If you have children or other dependents under the age of 17 you likely qualify for the Child Tax Credit.

You only need to complete the other worksheets in this publication if you also were. Then use Schedule 8812 to gure any additional child tax credit. See the instructions for Form 1040 line 19 or Form 1040NR line 19.

Complete the Earned Income Work-sheet later in this publication. You might also be able to claim an additional 500 credit the Credit for Other Dependents for your non-child dependents in tax year 2020. This is the nonrefundable amount of the child tax credit that you were able to claim.

Changes to the Child Tax Credit. See Tab C Dependents Table 1. Dependents who are age 17 or older.

The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit. Line 2 Enter the amount from Form 1040 Line 19. Enter this amount on Form 1040 line 12a.

All of the existing rules for claiming adult dependents on your tax return still apply and theyre largely the same for qualifying child dependents. Credit for Other Dependents. If you were sent here from your Instructions for Schedule 8812.

If NO you cant claim the child tax credit for this person. If you have dependents who dont qualify for the Child Tax Credit you may be able to claim the Credit for Other Dependents. You may be able to take the additional child tax credit on Form 1040 line 17b if you answered Yes on line 11 or line 12 above.

It is used to determine if you qualify for the credit and to calculate the amount of the credit you will receive. Or claim certain adoption or mortgage tax credit. 1545-0074 Attachment Sequence No.

Step 1 Is this person your qualifying child dependent. 20 Zeilen Instructions for Schedule 8812 Additional Child Tax Credit 2020 01132021 Form 1040. To claim the child tax credit andor the credit for other dependents you cant be a dependent of another taxpayer.

Taxpayers should use this publication if they have foreign earned income. All Dependents If YES go to Step 2. Starting with the 2018 tax year there have been notable changes to this tax credit.

What is the Child Tax Credit. Dependents who have individual taxpayer identification numbers. The 2020 Schedule 8812 Instructions are published as a separate booklet which you can find below.

Enter the amount from Line 10 of the Child Tax Credit and Credit for Other Dependents Worksheet in Publication 972 or Line 8 of the worksheet in the Form 1040 Instructions above. This is your child tax credit and credit for other dependents. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child.

Form 1040 Schedule 8812 Additional Child Tax Credit asks that you first complete the Child Tax Credit and Credit for Other Dependents Worksheet. Form 1040 2020 Additional Child Tax Credit Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040-SR or 1040-NR. Start with the Child Tax Credit and Credit for Other Dependents Worksheet later in this publi-cation.

If NO you cant claim the child tax credit for this person. March 13 2020. Meet a specific income requirement.

Step 1 Is this person your qualifying child dependent. The intake and interview sheet along with the Volunteer Resource Guide Tab G Nonrefundable Credits are critical tools needed to determine eligibility for the credit. Earned Income Worksheet for line 3 of the Line 14 Worksheet or line 6a of Schedule 8812 Additional Child Tax Credit Additional Medicare Tax and RRTA Tax Worksheet for line 7 of the Line 14 Worksheet.

The credit is now worth up to 2000 per qualifying child double the previous amount. This credit reduces your federal income tax bill by up to 2000 per child for the 2020 tax year. The maximum credit amount is 500 for each dependent who meets certain conditions.

See Tab C Dependents Table 1. All Dependents If YES go to Step 2. The taxpayer is eligible for the refundable credit if some portion of the nonrefundable Child Tax Credit was disallowed because the taxpayers tax liability was reduced to zero before the entire Child Tax Credit.

Publication 972 contains a worksheet to help taxpayers figure their child tax credit and the credit for other dependents. First complete your Form 1040 through line 17a also complete Schedule 5 line 72. You can get more from the credit than in the past.

The tax credit is not a deduction so if you claim the full 2000 and you owe 3000 in Federal taxes. All About Child Tax Credits. The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040.

Child Tax Credit and Credit for Other Dependents Worksheet.

Pdf Run Credit Card Authorization Credit Card Images Credit Card Card Template

Schedule C Excel Template New Schedule C Spreadsheet Google Spreadshee Schedule C Book Cover Template Excel Templates Templates

Https Www Cedarville Edu Media Files Pdf Financial Aid Forms 2020 Cedarville Verification Worksheet Dependent V5 Pdf

Form 11 Where To File What S So Trendy About Form 11 Where To File That Everyone Went Crazy Power Of Attorney Form Tax Guide Going Crazy

Pin By Zakiria On Zz History Teachers Financial Literacy Student Activities

Https Www Newburghschools Org Files Departments Payroll Withholdings2020 Federalstate Pdf

Pin On 2020 2021 Hybrid School Info

Tax Return Fake Income Tax Return Tax Return Credit Repair Companies

Https Www Irs Gov Pub Irs News Fs 12 09 Pdf

Https Www Irs Gov Pub Irs Prior I8839 2019 Pdf

Monthly Lesson Plan Template Beautiful Auto Insurance Lesson Plans High School Are Def Financial Plan Template Financial Budget Planner Budget Planner Template

Https Apps Irs Gov App Vita Content Globalmedia 4491 Other Income Pdf

W9 Form Download Fillable Form W 9 Request For Taxpayer Identification Fillable Forms Templates Blank Form

Http Www Chfainfo Com Participating Lenders Single Family Forms 1040 Mcc Pdf

Irs Form 1040 Schedule 8812 Download Fillable Pdf Or Fill Online Additional Child Tax Credit 2020 Templateroller

7 Linear 3rd Grade Paragraph Writing Worksheets Third Grade Writing Writing Homework Writing Checklist

2021 W4 Form How To Fill Out A W4 What You Need To Know Probability Worksheets Anger Management Worksheets Personal Hygiene Worksheets

Account Tracker Life Your Way Credit Card Tracker Project Planner Planner

Posting Komentar untuk "Child Tax Credit And Credit For Other Dependents Worksheet 2020 Form"